indiana inheritance tax exemptions

This is required only of individual estates that exceed a gross asset and prior taxable gift value of 1206 million 2412 for couples in 2022. Application for exemption must be filed before April 1 of the assessment year with the county assessor.

Calculating Inheritance Tax Laws Com

INHERITANCE TAX EXEMPTIONS AND DEDUCTIONS.

. For individuals dying before January 1 2013. Federal Estate Tax. By the appropriate tax rate.

25000 or less 1. The proceeds from life insurance on the life of a decedent are exempt from the inheritance tax imposed as a result of his death unless the proceeds become subject to distribution as part of his estate and subject to claims against his estate. The amount of each beneficiarys exemption is determined by the relationship of that beneficiary to the decedent.

IC 6-41-3-65 Annuity payments Sec. 2 the property continues to meet the requirements of IC 6-1. 1 the exempt property is owned occupied and used for educational literary scientific religious or charitable purposes.

Filing a typical tax return is simple but completing one in the name of a decedents estate requires a little more work. 25000 to 50000 2 over the first 25000 plus 25000. In general estates or beneficiaries of.

Transfers to a spouse are completely exempt from Indiana inheritance tax IC6-41-3-7. In general estates or beneficiaries of deceased Indiana nonresidents are required to file an inheritance tax return Form IH-12 if the value of the transfers is greater than the exemption allowed for that beneficiary if the property transferred is Indiana real property andor tangible personal property located in Indiana. Miscellaneous taxes and exemptions represents a specific individual material embodiment of a distinct intellectual or artistic creation found in Indiana State Library.

The proceeds from life insurance on the life of a decedent are exempt from the inheritance tax imposed as a result of his death unless the proceeds become subject to distribution as part of his estate and subject to claims against his estate. Indiana has a three class inheritance tax system and the exemptions and tax rates vary between classes based on the relationship of the recipient to the decedent. The application must be refiled every even year unless.

Indianas inheritance tax still applies. The exemption for the federal estate tax is 1170 million in 2021 and increases to 1206 million in 2022. Indiana levies no state taxes on the inheritance or estates of residents and nonresidents who own property there.

This item is available to borrow from 1 library branch. The inheritance tax rates are listed in the following tables. IC 6-41-3-65 Annuity payments.

Spouse Children Grandchildren Parents Effective July 1 1997 the first 10000000 of an estate going to an heir in Class A is exempt of inheritance tax. Though Indiana does not have an estate tax you still may have to pay the federal estate tax if you have enough assets. Indiana Inheritance Tax Exemptions and Rates.

The first inheritance tax law of indiana was passed in 1913. Justia US Law US Codes and Statutes Indiana Code 2016 Indiana Code TITLE 6. The item Inheritance tax.

DEATH TAXES CHAPTER 3. Indiana state income tax rate is 323. Class A Net Taxable Value of Property Interests Transferred Inheritance Tax 25000 or less 1 of net taxable value Over 25000 but not over 50000 250 plus 2 of net taxable value over 25000 Over 50000 but not over 200000 750 plus 3 of net taxable value over 50000 Over 200000 but not over.

There is also an unlimited charitable deduction for inheritance tax purposes. No inheritance tax returns Form IH-6 for Indiana residents and Form IH-12 for nonresidents have to be prepared or filed. Transfers to a spouse are completely exempt from Indiana inheritance tax IC6-41-3-7.

Class A Net Taxable Value of Property Interests Transferred Inheritance Tax 25000 or less 1 of net taxable value Over 25000 but not over 50000 250 plus 2 of net taxable value over 25000 Over 50000 but not over 200000 750 plus 3 of net taxable. In 2022 Connecticut estate taxes will range from 116 to 12 with a 91-million. As added by Acts 1976 PL18 SEC1.

Estates over the first 10000000 the tax is as follows. A 2012 Indiana law began a slow phase-out of the Indiana Inheritance Tax that applied a credit increasing year by year to the total Indiana Inheritance Tax and was repealed for the estates of decedents dying on or after January 1 2022. Child stepchild parent grandparent grandchild and other lineal ancestor or descendant.

For example if you made gifts of assets during your lifetime valued at 4 million and you owned assets valued at 6 million at the time of your death your estate would be subject to federal gift and estate taxes for the combined value of 10 million at a tax rate of 40 percent. Class A Beneficiaries Exemptions effective 070197. The available exemptions and the tax rates usually vary based on how closely each transferee is related if at all to the decedent.

The decedents surviving spouse pays no inheritance tax due to an unlimited marital deduction. The inheritance tax rates for each class are. IC 6-41-3-65 Annuity payments Sec.

Are required to file an inheritance tax return Form IH-6 with the appropriate probate court if the value of transfers to any beneficiary is greater than the exemption allowed for that beneficiary. As added by Acts 1976 PL18 SEC1.

Funny Security Staff Sleeping Sleep Deprivation Sleep Funny

State Estate And Inheritance Taxes Itep

States With No Estate Tax Or Inheritance Tax Plan Where You Die

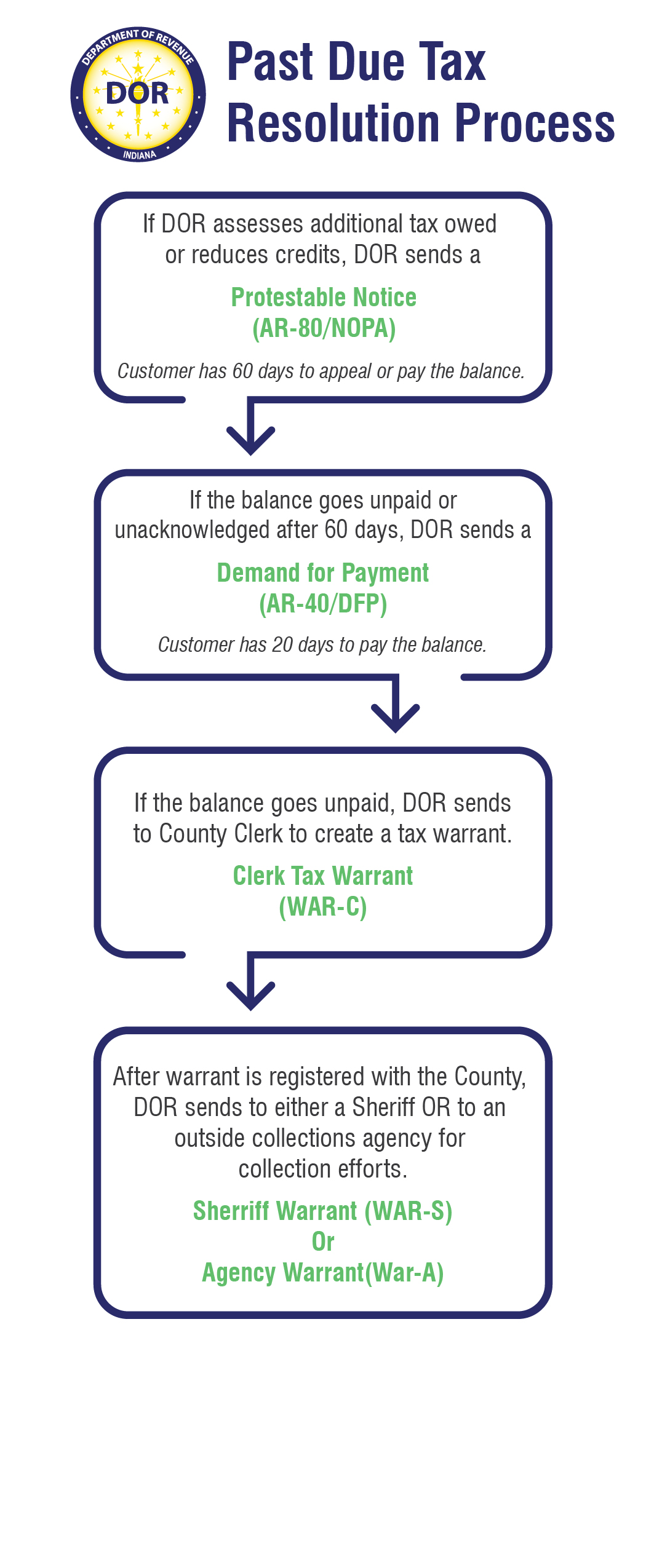

Dor Make Estimated Tax Payments Electronically

Pennsylvania S Property Tax Rent Rebate Program May Help Low Income Households Legal Aid Of Southeastern Pennsylvania

Should Indiana Phase Out Inheritance Tax Indianapolis Business Journal

States With Highest And Lowest Sales Tax Rates

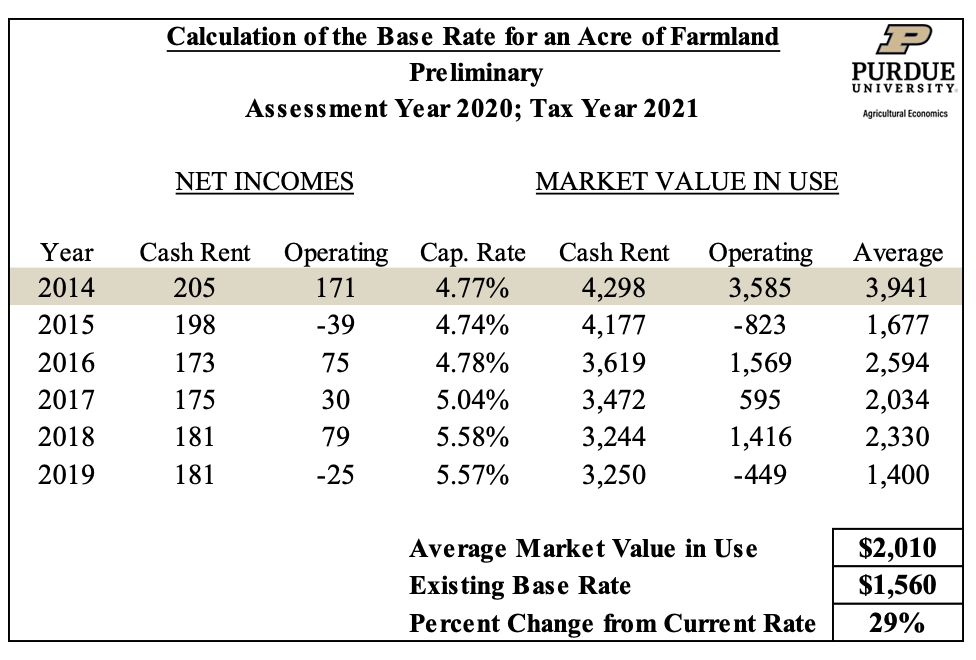

Farmland Assessments Tax Bills Purdue Agricultural Economics

Indiana Estate Tax Everything You Need To Know Smartasset

The Tax Cuts And Jobs Act What Does It Mean For Medical Residents

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Does Indiana Have An Inheritance Tax Indianapolis Estate Planning Attorneys

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With An Inheritance Tax Recently Updated For 2020 Jrc Insurance Group

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Investment Banker Resume Example Resume Examples Job Resume Samples Good Resume Examples